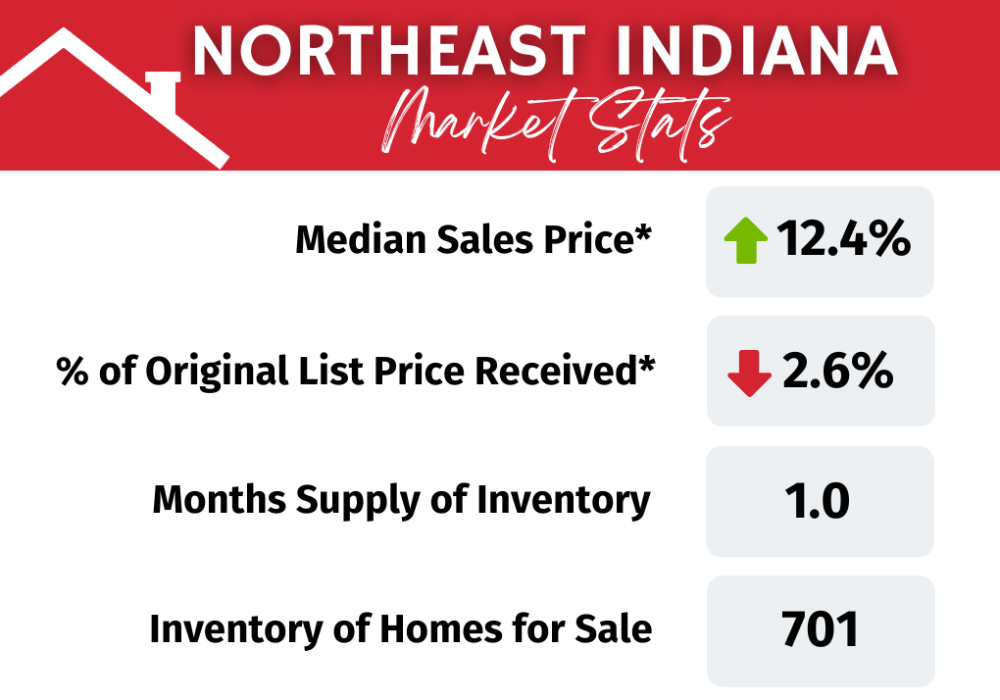

Did you know that home ownership is still one of the best tools to hedge against inflation? While recent news often highlights decreasing stock portfolios, home values historically appreciate over the long-term. As you build equity in your home, you increase your overall net worth. The National Association of Realtors released new data this month revealing middle-income homeowners accumulated $122,100 in wealth as their homes appreciated by 68% over the last 10 years, low-income homeowners were able to build $98,900 in wealth, while upper-income households saw an increase of $150,800. Though gains of the past decade varied across the country, Allen County homeowners have certainly witnessed this advantage. While the price of groceries, gas, and other daily living expenses have gone up over the last 12 months, local home prices also rose again. From March 2022 to March 2023, the median sales price in the 7-county region went up 12.4% to $227,000. The low inventory of homes for sale, both new and existing homes, will continue to fuel steadily rising prices in our local market in the foreseeable future. Though inventory in our region always increases in the spring and summer, it will likely remain below a 2-month supply. A balanced housing market is considered to be a 4-to-6-month supply of inventory. New data from the Mortgage Bankers Association shows a decline in the number of loans in forbearance. This is an interesting economic indicator. The home mortgage loans of today are not going into foreclosure like the home loans in the last recession. Instead, the increased equity value in one’s home is a hedge against current inflation, proving that real estate is indeed a solid investment. Take the first step towards home ownership today. Don't hesitate to reach out to us.